Ethereum Average Transaction and Gas Fees - How do we strike the right balance?

The surging interest in DeFi has continued to push Ethereum transaction fees to record levels, the average transaction fee today stands at $17.48 and some more complex transactions can easily hit 3 figures. As we eagerly await Phase 2 of the Ethereum 2 launch, which promises to scale Ethereum to 100,000 transactions per second and should result in a much needed and significant drop in gas fees, but what can the avid DeFi-er do in the interim to save on gas fees?

Here are just a few options; switch to a Layer 2 scaling solution, look at alternatives to Ethereum that have a healthy DeFi offering, wait for the possible implementation of EIP 1559 or finally just accept the high cost of DeFi transactions on your way to the moon? Let’s consider each of these in turn.

There are a number of Layer 2 scaling solutions for Ethereum (I recommend watching The Defiant series of videos for a very entertaining deep dive into these). The premise is simple, you lock up assets on the Ethereum Mainnet that can then be traded back and forth between parties in the Layer 2 solution before being returned to Mainnet when your trading is done. The fees are much lower once your assets are in Layer 2, but you have to pay the price of one (or more) transactions to get your assets on to Layer 2 and possibly the same again on the way back out. Once you’ve locked up your assets they’re also siloed to the given DeFi project until you unlock them again, reducing your flexibility.

As for alternative chains, there are myriad options, with Polkadot, EOS and NEO to name just a handful. Each of these has varying levels of maturity and will require you to switch wallets as you move assets between chains. Like Layer 2 scaling, you’ll have to pay to move assets off Ethereum, but the diversity of projects on your chosen chain will probably be a key driver. The effort to understand the dynamics of a different chain and the associated ecosystem may well be a blocker.

The heated debate over EIP 1559 continues to rage. This Ethereum Improvement Proposal is set to burn some of the fees associated with each transaction and switch mining fees to a tipping model. It also expands the block capacity to allow more transactions at peak times while maintaining the long term trend. It is likely to reduce the gas price volatility and therefore prevent some of the extreme spikes, but is unlikely to reduce the average transaction cost in the long term as competition for limited block capacity continues to increase.

Finally, you could just continue to trade on Mainnet, waiting for a dip in fees to place your transactions and look longingly to the bright future of Ethereum 2.0.

Don’t forget about the private keys - Who’s Good at Keeping Secrets in DeFi?

With both the increase in institutional investment into crypto markets and the innovation that’s happening in DeFi at the moment to drive down costs whilst increasing opportunity and the freedom to transact, it’s easy to lose sight of the private keys. The current lack of good wallets that can accommodate for high volume and multiple transactional activities, eg yield farming, from a security and automation stance is holding the Ethereum ecosystem back.

Institutional investors holding a lot of value in DeFi applications need to consider a DeFi enabled custodian such as Trustology who provides not only a true custody solution that’s highly secure, insured and accessible but also the automation, safeguard and data controls needed to provide users with the protection and transparency they need to comfortably and compliantly transact in DeFi.

Learn more about our DeFi solutions and key features:

Tap DeFi innovation from the security of a custodial wallet and platform

Related readings

Decoding and Ethereum Transaction

DeFi Firewall–The Devil is in the Custodial Details

Trustology Integrates WalletConnect for DeFi Secure Access

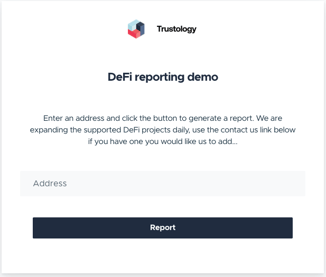

NEW! DeFi Reporting - Try it out Now!

Anyone can try out our new DeFi reporting service. Aimed at supporting users' need for better end-of-month reconciliations and easy compliance reporting, get all the details on your ethereum transactions down to the last swap. One view and report, so go on give it try!