In a $96B+ DeFi market, yield farming has become a popular strategy for crypto hedge funds and investment managers. But how can institutional investors look to achieve secure, compliant access to carry out their proposed strategies? This is where DeFi custodians can help.

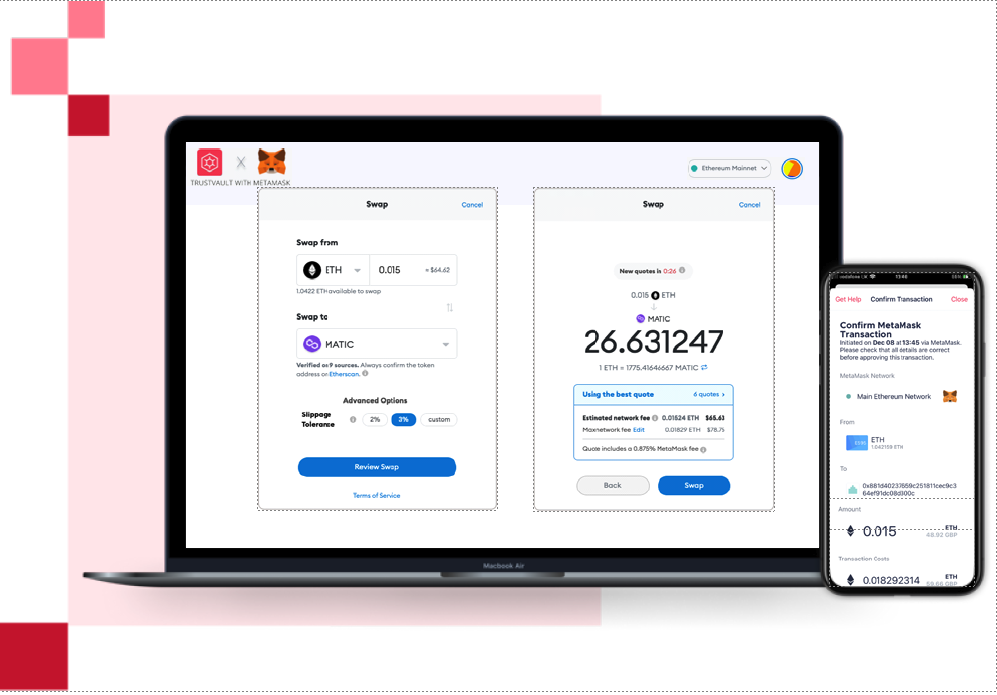

In part one of our tutorial series on yield farming we show you how to swap and lend digital assets using our secure and compliant crypto custodial wallet—TrustVault. Part 2 of our series will focus on borrowing against deposited assets as collateral to reinvest on other solutions to maximise your earnings.

Here’s what we’ll show you today:

- Step 1: Swapping ETH for MATIC

- Step 2: Depositing your MATIC tokens with Aave on Polygon

Related readings:

How to earn interest with TrustVault+MetaMask

Decoding an Ethereum Transaction