For those institutional investors who have been brave enough to jump into crypto markets and DeFi today, yields can be high. However, for years institutions struggled with fully adopting cryptoassets due to a lack of regulatory clarity. Enter 5AMLD. Since its introduction, subsequent oversight by the FCA and SEC and market infrastructure improvements within crypto markets, institutional adoption is on the rise. Things are changing for sure. We have a flourishing DeFi market with over USD100B in total locked value and the number of wallets and users have increased to well over 40 million.

One thing that hasn’t changed, however, is the sense of standardisation. Hence, the formation of the Standards Board for Alternative Investment (SBAI).

SBAI is a global alliance of alternative investment managers and allocators of the Alternative Investments Standards. Its Individual Investor Chapter includes over 90 major international investors accounting for over US$ 4TN, across pension and endowment funds, sovereign wealth funds and funds of funds. As such, the organisation has become recognised as a reputable go-to source for institutional investors and private investors. They’ve set the standards that many established funds already follow to provide accountability and comfort to their investors. They have recently released pointers for institutional investors to think strongly on when it comes to Operational Due Diligence Requirements across blockchains, exchanges and DeFi.

In this blog, we break down their recommendations and how Trustology is already ahead of the game of operational due diligence. Read on to learn more.

SBAI Report Highlights

The report points out that digital assets operate within a very different infrastructure than traditional asset classes and that any due diligence needs to account for certain risks.

Even after 5AMLD was introduced, cryptoassets’ reputation as a tool for money laundering and criminal offences still poses a big concern for authorities. Therefore failing to meet KYC and AML requirements can have a heavy fine attached as we saw with the popular trading app Robinhood which received a $30 Million fine after an anti-money laundering probe found it in breach of the rules. So SBAI took it upon themselves to come up with some Operational Due Diligence standards for institutional investors to help mitigate risks. However, meeting these standards can take a lot of work, but it’s become imperative given the uncertainty with crypto markets and what’s the best practice to follow. Here’s a brief rundown of what the report covers:

The Standards

The key areas of the Operational Due Diligence Standards that are covered include:

- Custody

- Trade processes

- Valuation

- Asset verification

- Conflicts of interest, and

- Regulatory risk.

Custody

.jpeg?width=3840&name=AdobeStock_188739092%20(1).jpeg)

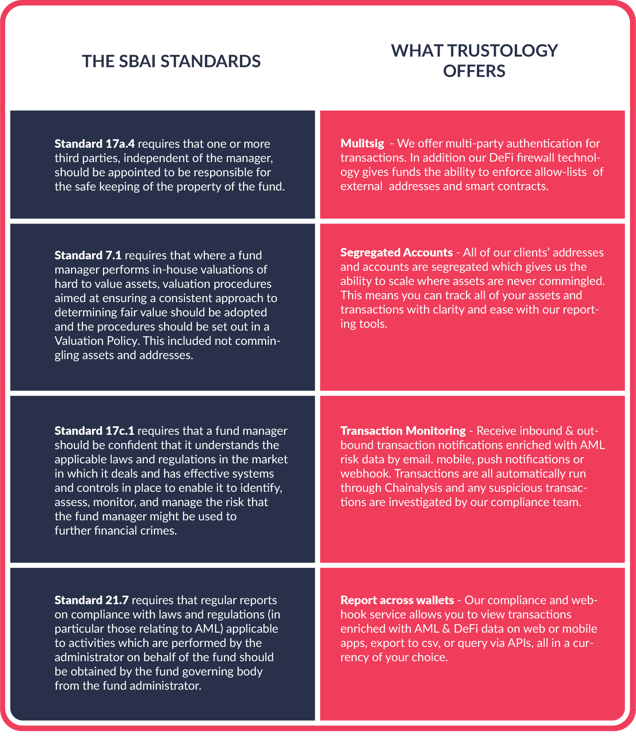

The report puts a huge emphasis on the importance of custody for digital asset management. It explores the use of third-party custodians and self-custody; it concludes in Standard 17a.4 that one or more third parties, independent of the manager, should be appointed to be responsible for the safekeeping of the property of the fund.

In their minimum standards section for custodians, they ask that custodians be qualified with a ‘state’ license and also be insured, including for insider theft. Coverage may be immaterial to the value of asset; however, SBAI notes investors may gain comfort from reputable insurers willing to underwrite the risk regardless of the level of cover.

As of October 2021, Trustology has been registered as a cryptoassets firm with the Financial Conduct Authority (FCA) in the UK. We've also secured insurance coverage brokered through Marsh.

SBAI recognises that there may be times when self-custody of assets is required, but serious questions should be asked about why an independent custodian is not being used. The way in which self-custody is managed can create severe risks for a fund.

There are several methods that self-custody takes, such as cold storage, which is very slow and inherently expensive or the use of a hardware or online wallet. The hardware wallet requires that one individual handles its safekeeping and doesn’t offer additional security measures such as multi-party authorisation. For both hardware and online wallets if the holder forgets the password or passes away there is no way to recover the private key and the assets will be lost forever.

They stipulate that where there are available institutional third-party custodians for the specific crypto asset they should be used.

It's also important that as a crypto fund you are able to answer tough questions from your investors and some of those are also set out in the standards. Questions should speak to the experience of the team behind the custody solution. At Trustology, our team has years of experience in leading blockchain research and development teams at large banks such as UBS, BNY Mellon, Royal Bank of Scotland, Santander and more.

Crypto Funds should be looking for a custodian with multi-party authentication (multisig), private-key recovery plans and the ability to change management rights and permissions. All of this is available with Trustology's TrustVault solution. Learn more here.

Asset Verification

In this section, Standard 7.1 explains that auditors and fund administrators should be able to independently verify the crypto assets in the portfolio. They specifically mention the steps to do this if the asset is stored on a single address & not commingled with the custodian’s other assets. If the assets are commingled as they are on exchanges and other custodians this verification process can be much more complicated.

The commingling of assets in what we call an omnibus account inevitably leads to issues over lack of transparency, it results in accounting reconciliation costs, balance sheet ambiguity, and owners not being able to independently audit their balances. A commingled address also raises many compliance questions that need to be answered - who do the assets belong to? What happens to them in case of liquidation? Are the funds being used for unauthorised purposes?

With Trustology's TrustVault all of our clients’ addresses and accounts are segregated which gives us the ability to scale where assets are never commingled. This means you can track all of your assets and transactions with clarity and ease with our reporting tools.

AML & KYC

AML & KYC checks by the manager and service providers continue to be an important consideration during Operational Due Diligence. Under Standard 17.c1 the fund manager must have effective systems and controls in place to enable it to identify, assess, monitor, and manage the risk. This is important as breaches of AML & KYC rules can have a massive financial impact on the fund through fines and penalties. Monitoring this risk can be done independently through services such as Chainalysis but they can be costly and time-consuming with each transaction needing to be monitored and if found to be in breach then reported to the NCA (National Crime Agency).

A value-added custodian like Trustology will have those checks built into the wallet solution. When transactions are received by one of our clients they are all automatically run through Chainalysis and any suspicious transactions are flagged and investigated by our compliance team. Equally, outbound transactions are also monitored and investigated. We also include compliance data in the webhook payloads, so that customers can perform their own additional checks. This service will help with funds to meet Standard 21.7 which requires that regular reports on compliance with laws and regulations are also made available.

Why does this matter?

With regulators catching up with the crypto space now it is important for crypto and DeFi funds to keep ahead of the curve. An organisation like SBAI will have some influence or input into how funds can manage expectations from regulators to best proceed in this space compliantly at minimal risk. By following the SBAI standards for best practice at this point you can ensure that your crypto fund stays on the right side of regulators and mitigate your risk levels.

There is increasing interest from affluent investors in this asset class and it is putting wealth managers and traditional funds under increasing pressure to add crypto to their offerings. A survey by Nickel Digital Asset Management in September 2021 of over 1000 institutional investors and wealth managers from the US, UK, France, Germany and the UAE who collectively don't currently have exposure to cryptocurrencies and digital assets found that 62% expect to invest in these assets for the first time within the next year.

With that added pressure it is vital that funds that do decide to go into crypto do so quickly to gain the competitive edge but without exposing themselves to additional risks. With Trustology our crypto and DeFi custody solution does more than just protect your digital assets and private keys. It gives you the tools to monitor transactions for AML compliance, track and audit all of your assets and transactions and ensure that there are authorisation rules in place to protect your investors and maintain your funds trading strategy.

We call this value-added custody and if you are looking for a safer, faster and easier way to manage a crypto fund talk to us.

Related readings

Trustology Gets Full FCA Registration as Cryptoassets Firm

TrustVault. The Safest Crypto Account for Institutional Investors

High Yields Ahead - New Voyager DeFi Fund Backed By Trustology Custody

TrustTalks

Stay up-to-date with the latest crypto news, events, and crypto custody with Trustology. Over 2000 subscribers receive our monthly round up of what made the headlines, upcoming events that institutions need to know about and the latest developments in crypto custody and to our TrustVault platform. Be in the know, sign up today.